If you’re looking to make some extra money in 2022, you’ll want to know when the 3 paycheck months are.

This year, they fall in April, July, August, and September. If you can manage your finances well and put some extra money aside during those months, you’ll be able to enjoy a little financial cushion later on in the year.

Keep reading for more information about the three paycheck months!

Pin It! 😎

What Does The 3 Paycheck Months In 2022 Mean For You?

The three paycheck months are when most people receive three paychecks instead of two. This is because there are five weeks in those months, as opposed to the usual four.

If you’re paid bi-weekly, this means that you’ll receive an extra paycheck during these three months. The extra money can come in handy for unexpected expenses or for putting a little extra money aside for the future.

Biweekly vs Semimonthly Payroll Periods

If you’re not sure when your company’s payroll periods are, you can check the employee handbook or ask your HR representative. Most companies have either biweekly or semimonthly payroll periods.

With a biweekly payroll period, employees receive 26 paychecks in a year. With a semimonthly payroll period, employees receive 24 paychecks in a year.

What Are The 3 Paycheck Months In 2022?

If you’re looking to receive three paychecks in 2022, you’ll want to know when the three paycheck months are.

If you got your first paycheck in 2022 on Friday, January 7th, your three paycheck months will be April and September this year!

This calendar highlights the months with 3 paychecks for payday starting on January 7th.

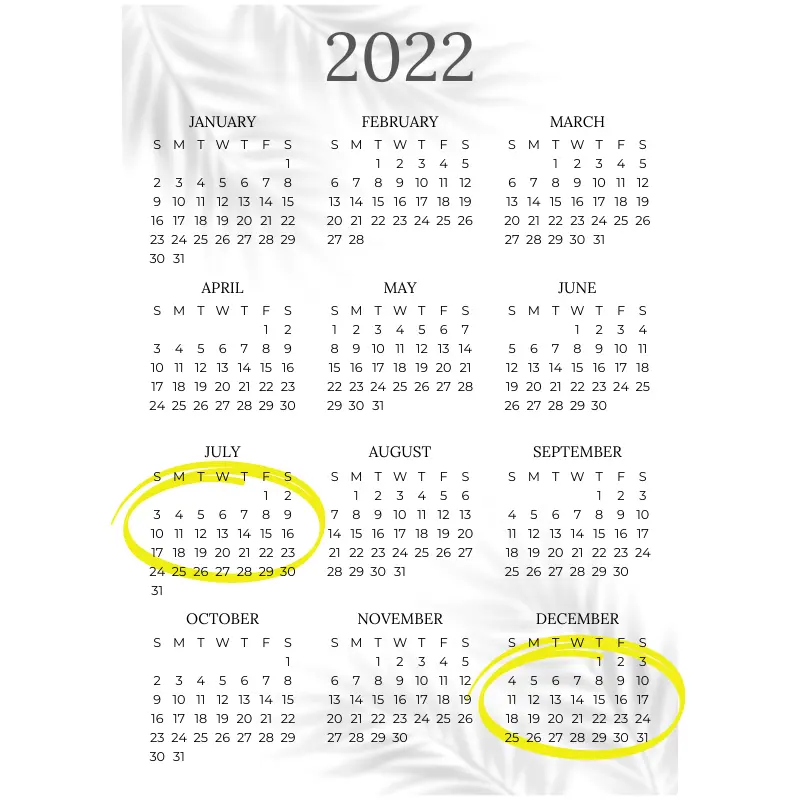

If you got your first paycheck in 2022 on Friday, January 14th, then your three paycheck months will be in July and December this year!

The following calendar highlights the months with three paychecks for payday starting on January 14th.

Friday Biweekly Paydays Chart for 2022

As you can see, the three paycheck months vary depending on when your first paycheck of the year is. If you’re not sure when your first paycheck will be, you can ask your HR representative or check your company’s payroll schedule.

Knowing when the three paycheck months are can help you budget and plan for the year ahead. If you’re able to save some extra money during those months, you’ll be in good shape financially for the rest of the year.

More Reading: How to Save Money Fast on a Low Income

If you’re looking to make the most of the three paycheck months, here are a few tips:

3 paycheck months #1. Make a budget and stick to it

This is always a good idea, but it’s especially important during these three months when you have more money coming in. If you know what you’re spending your money on, you’ll be less likely to overspend.

Make managing money easy! Don’t go it alone! Truebill makes it easy for you to save more, spend less, and take charge of your financial life. Truebill is a FREE to use app.

3 paycheck months #2. Save as much as possible

One great way to take advantage of the three paycheck months is to save as much money as possible. You can put this money into savings or invest it in something that will help you earn interest.

Easily save and invest with Acorns, plus get a $5 FREE bonus investment through this link!

3 paycheck months #3. Start an Emergency Fund

If you don’t have one already, start an emergency fund. An emergency fund is a money set aside in case of a financial emergency, like a job loss or a large unexpected expense.

Having an emergency fund can help reduce stress and anxiety about money and give you a buffer if something goes wrong.

3 paycheck months #4. Create a Budget

Budgeting is one of the most important things you can do to get your finances in order. A budget helps you track your income and expenses, so you can see where your money is going and make adjustments as needed.

3 paycheck months #5. Stay on Top of Your Bills

One of the best ways to stay out of debt is to stay on top of your bills. Make sure you know when each bill is due and pay it on time, every time. This will help you avoid late fees and keep your credit score healthy.

More Reading: Why Fixed Expenses are Difficult to Reduce

3 paycheck months #6. Save for retirement

Retirement may seem like a long way off, but it’s never too early to start saving. The sooner you start saving, the more time your money has to grow.

If you’re not sure where to start, talk to a financial advisor or use a retirement calculator to see how much you need to save.

3 paycheck months #7. Invest in Yourself

One of the best investments you can make is in yourself. Investing in your education, training, or professional development can help you improve your skills and earn more money over time.

3 paycheck months #8. Think Long Term

When it comes to finances, it’s important to think long-term. Making short-term sacrifices now can pay off big in the future.

So rather than focusing on what you can’t afford, focus on what you want to achieve down the road and work towards those goals.

3 paycheck months #9. Prepay your bills

If you have the extra cash, prepaying your bills can help you save money on interest and fees. It can also help you stay on top of your finances and avoid late payments.

More Reading: How to Reduce Housing Costs

3 paycheck months #10. Create a Debt repayment plan

If you have debt, creating a repayment plan can help you pay it off faster and save money on interest. There are many different ways to do this, so find one that works for you and stick to it.

3 paycheck months #11. Build Your Credit Score

Your credit score is a reflection of your credit history and financial health. A high credit score can help you get approved for loans and other financial products, while a low credit score can lead to higher interest rates and fees.

You can improve your credit score by paying your bills on time, using less than 30% of your available credit, and maintaining a good credit history.

3 paycheck months #12. Start Saving for a rainy day

No one knows when an emergency will happen, but you can be prepared by starting to save now. Starting an emergency fund with even a small amount of money can help you cover unexpected expenses and avoid going into debt.

3 paycheck months #13. Invest in your future

One of the best things you can do for your future is to invest in yourself. This could mean going back to school, taking courses to improve your skills, or starting a savings plan for retirement.

The sooner you start, the better off you’ll be down the road.

3 paycheck months #14. Think outside the box

When it comes to finances, there are a lot of conventional wisdom. But that doesn’t mean it’s always the best advice. Sometimes, thinking outside the box can help you save money and achieve your financial goals.

So don’t be afraid to try something new if it means it could help you reach your goals faster.

You need to find what works best for you and stick with it. These are just a few ideas to get you started. When it comes to your finances, there’s no one-size-fits-all solution. You need to find what works best for you and stick with it.

3 paycheck months #15. Don’t be Afraid to Ask for Help

If you’re struggling with your finances, don’t be afraid to ask for help. There are plenty of resources available, including online calculators, budgeting tools, and financial advisors.

Don’t try to go it alone – get the support you need to make sound financial decisions.

3 paycheck months #16. Stay Positive

It can be tough when you’re feeling overwhelmed by your finances, but it’s important to stay positive. Changing your mindset can make a big difference in how you handle money.

Remember, you’re not alone – there are plenty of people who have been in your shoes and have managed to get their finances in order. With a little effort and some positive thinking, you can do it too.

People also ask

How many 3 paycheck months in 2022?

Answer: How many 3 paycheck months are there in 2022? There are Four 3 paycheck months in 2022 namely April, July, August, and September.

What months do we get 3 paychecks in 2020?

Answer: The three paycheck months for 2020 were January, May, July and October.

What month do we get paid 3 times 2022?

Answer: Depending on when you started getting paid at the beginning of the year, the Months you get paid 3 times fall in April, July, August, and September.

Pin it! 😎

Conclusion – 3 Paycheck Months in 2022

If you got your first paycheck in 2022 on Friday, January 7th, your three paycheck months will be April and September of this year and If you got your first paycheck in 2022 on Friday, January 14th, then your three paycheck months will be in July and December of this year!

Use the extra pay wisely by using it to save, invest or pay down debt. Be sure to have a plan in place so you don’t find yourself spending it all before the next paycheck month rolls around.

Over To You

What are your thoughts? Do you like getting three paychecks a year, or would you prefer something else? Let me know in the comments below. :)”

Latest Articles

- Why is Personal Finance Dependent Upon Your Behavior?

- Hosting an Online Garage Sale: Go from Clutter to Cash now

- 11+Cheap(or Free) things to do in retirement: Do more with less!

- Coast FIRE: Path to Financial Independence with Less Sacrifice

- Cash Stuffing Method: The Ultimate Financial Hack You Need to Know